Law firms face numerous compliance challenges in their day-to-day operations, particularly during client onboarding. This critical process entails integrating new clients into the firm’s workflow as well as managing their legal cases.

A systematic and meticulous approach is required to ensure that all relevant laws and regulations are followed and that the risks associated with each client are thoroughly assessed and managed.

In this article, we will look at the most common compliance challenges that law firms face when onboarding new clients, as well as best practices for ensuring an effective and lawful approach.

The Importance of Conducting Conflict of Interest Checks

Managing potential conflicts of interest is one of the most significant compliance challenges that law firms face during the client intake process. A conflict of interest arises when a lawyer or law firm represents two or more clients whose interests are conflicting or potentially conflicting. In such cases, it is critical that the lawyer or law firm demonstrate their ability to provide independent and impartial representation to each client.

Law firms must implement a thorough conflict of interest screening process to reduce the risk of conflicts of interest. This usually includes conducting in-depth research on the clients and their cases and comparing the results to the firm’s existing client and matter databases. If a potential conflict is discovered, the firm must assess its scope and determine whether it can be managed. Obtaining consent from all parties involved, for example, or using ethical screens are two possible solutions.

Implementing Anti-Money Laundering Measures

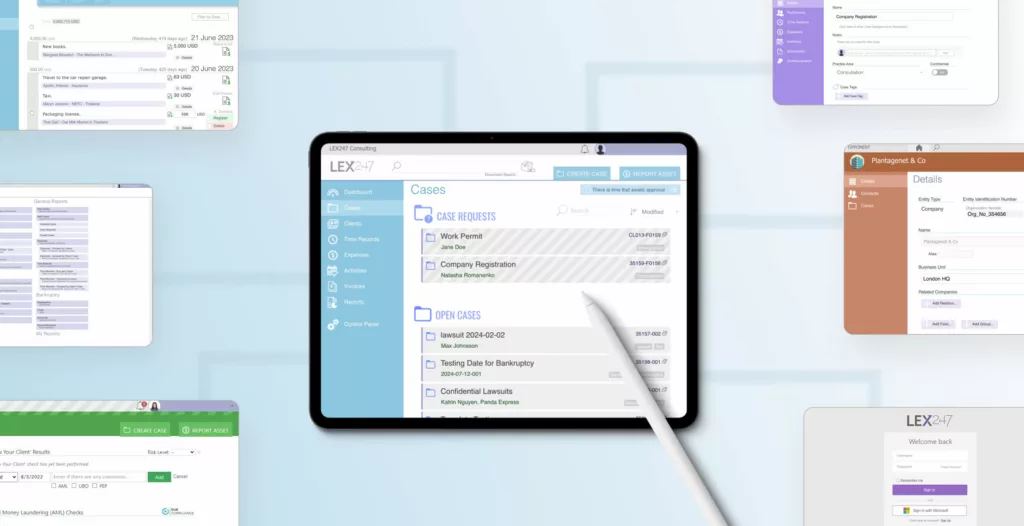

The risk of money laundering is another critical compliance challenge that law firms face during the client intake process. Money laundering is the act of concealing and disguising the proceeds of illegal activities, and it poses a significant threat to law firms. Law firms must implement effective anti-money laundering (AML) measures, such as customer due diligence and ongoing monitoring, to mitigate this risk.

Customer due diligence involves verifying clients’ identities, running background checks, and determining the source and nature of their funds. Ongoing monitoring involves evaluating client transactions and activities on a regular basis to detect any suspicious behavior.

It is important for law firms to stay current on AML regulations and best practices. These can change quickly in response to new money laundering threats and techniques, so staying informed and implementing the most effective countermeasures is essential.

The Necessity of Know Your Client (KYC) Procedures

Let’s talk about another important compliance measure that can help law firms manage risks during the client intake process: Know Your Client (KYC) procedures. These procedures involve verifying clients’ identities and gathering information about their business activities and ownership structure.

This information is then evaluated to determine the level of risk associated with each client and whether any illegal or unethical activities are taking place. By implementing KYC procedures, law firms can better understand their clients and make more informed decisions about representing them.

Screening for Politically Exposed Persons (PEPs)

When dealing with clients, law firms must exercise caution when dealing with Politically Exposed Persons (PEPs). PEPs are individuals who hold or have held prominent public positions and are therefore more vulnerable to corruption or bribery.

Law firms must implement effective screening procedures for identifying PEPs and conducting enhanced due diligence checks to ensure compliance and reduce the risk of financial crime. They can ensure that they are not inadvertently facilitating any illegal activity by doing so.

Client Intake Best Practices

Law firms can ensure an effective and compliant client intake process by following these best practices:

01. Streamline the process

Law firms should make the intake process efficient by automating certain tasks like conflict of interest screening and KYC procedures, and by creating standard templates and checklists.

02. Conduct thorough due diligence

To assess risk, law firms must perform comprehensive due diligence on all new clients, verifying their identity, running background checks, and checking the source and nature of their funds.

03. Maintain complete and accurate records

Law firms must keep precise records of all compliance-related activities, such as conflict of interest assessments, anti-money laundering measures, KYC procedures, and PEP screenings.

04. Adhere to relevant laws and regulations

Law firms must abide by all applicable laws and regulations, including anti-money laundering (AML) and combating the financing of terrorism (CFT) legislation, and follow ethical codes of conduct.

05. Regularly review and update processes

Law firms must frequently assess their intake processes to ensure they are efficient and compliant, and update their due diligence procedures, screening tools, and conflict of interest management as needed.

By following these best practices, law firms can ensure a successful client intake process while reducing the risks of noncompliance.